Admin wrote: Tue Jul 01, 2025 1:35 pm

https://the.ismaili/ke/en/news/mawlana- ... -president

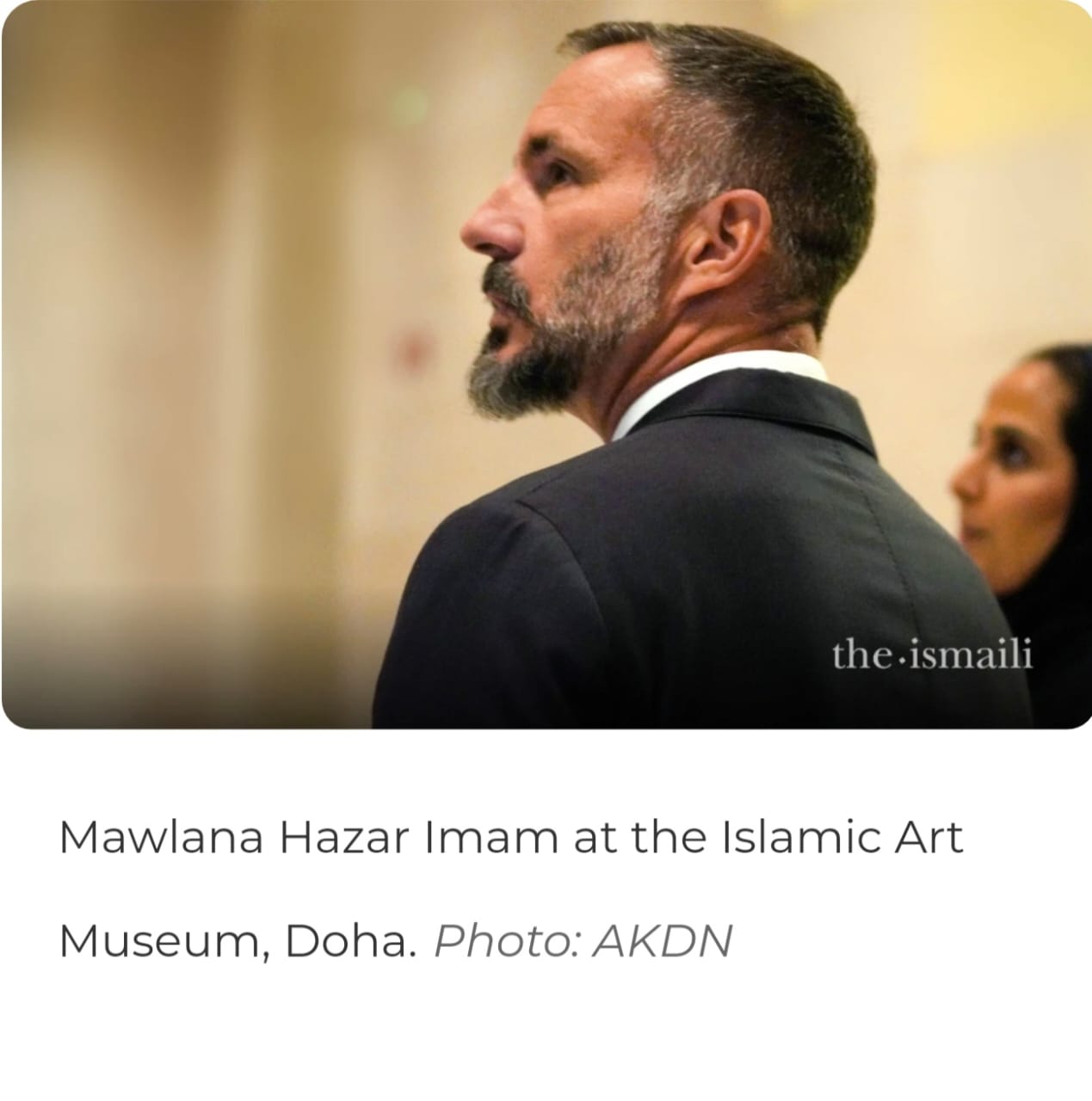

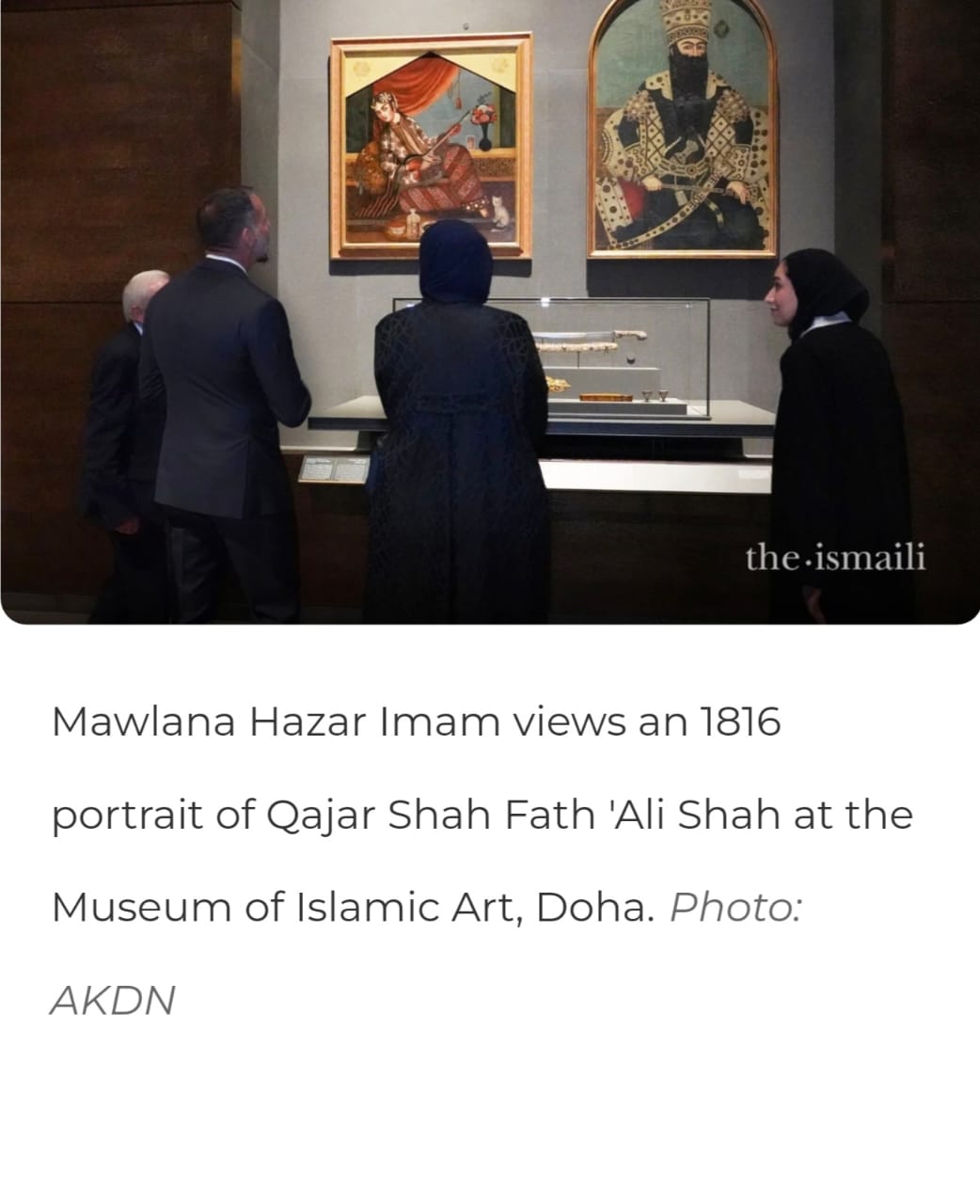

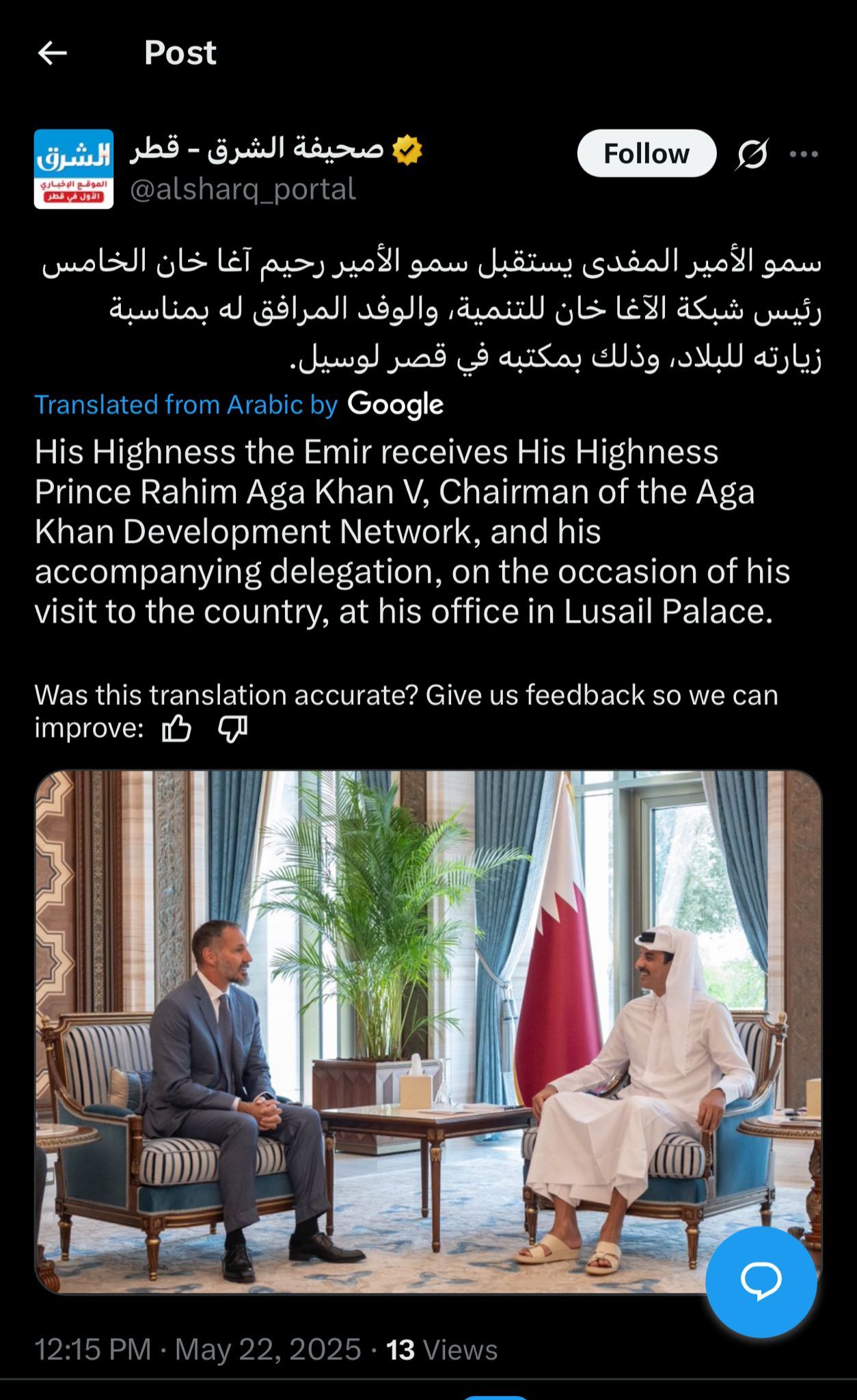

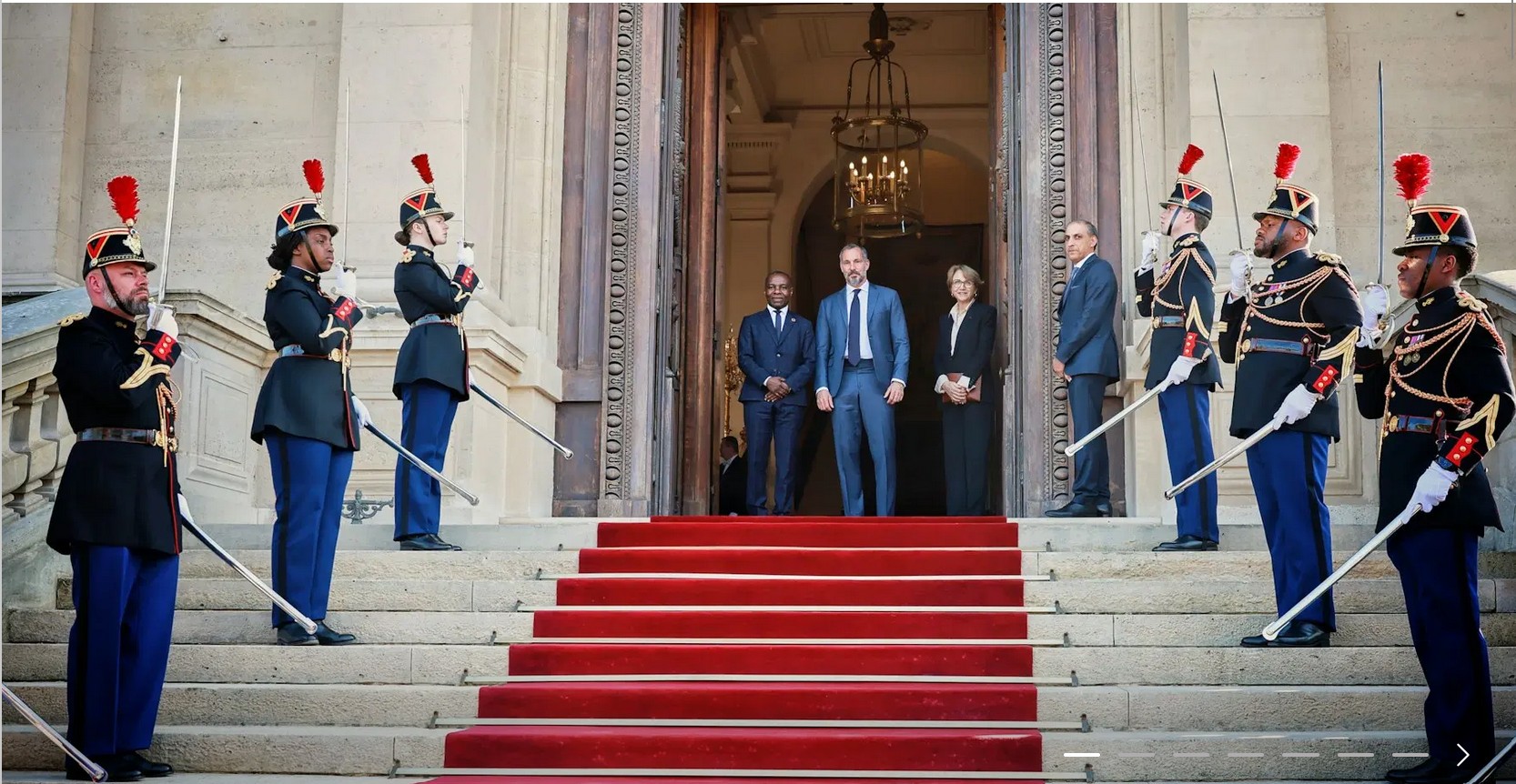

Mawlana Hazar Imam meets World Bank President

Kenya • 01 Jul 2025

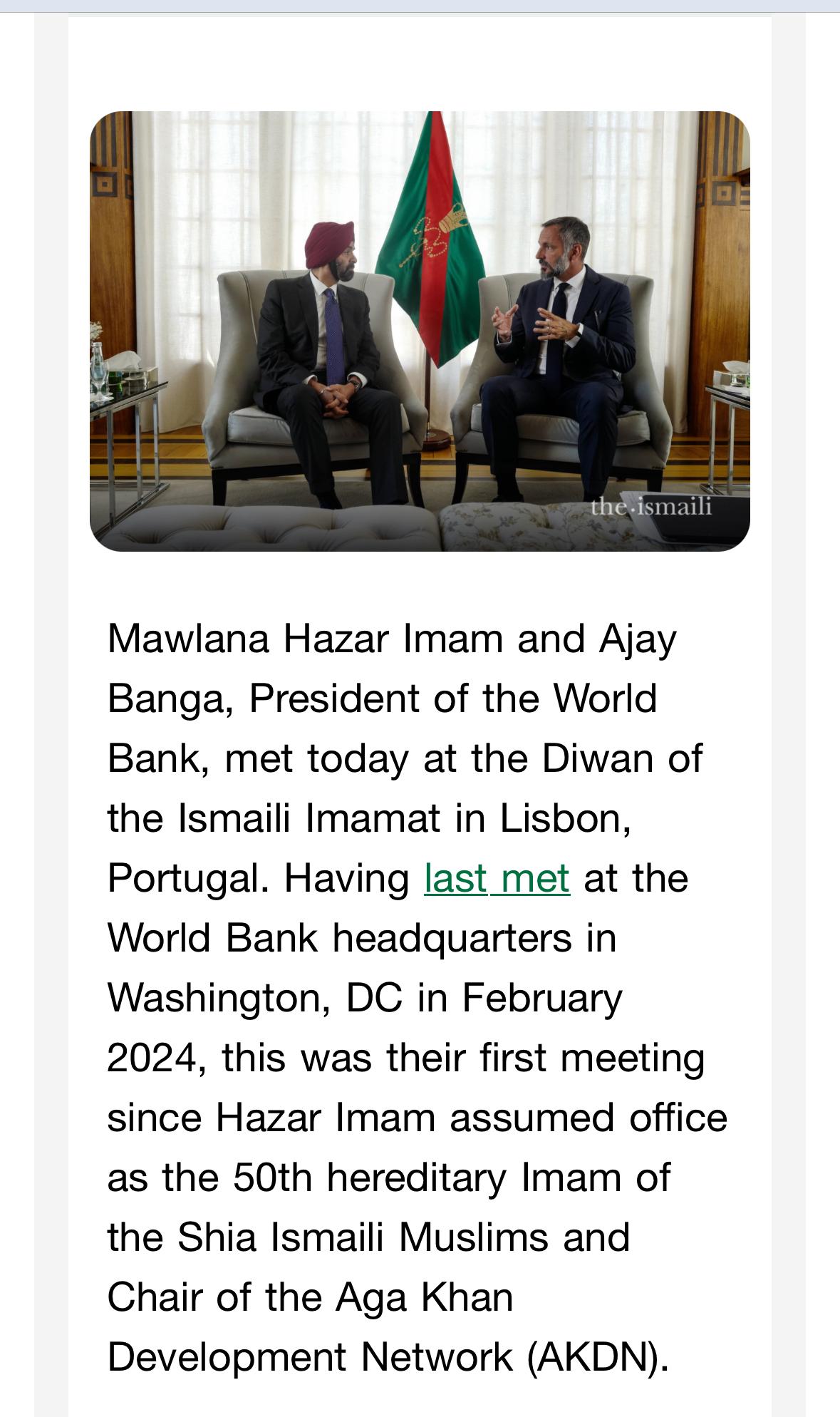

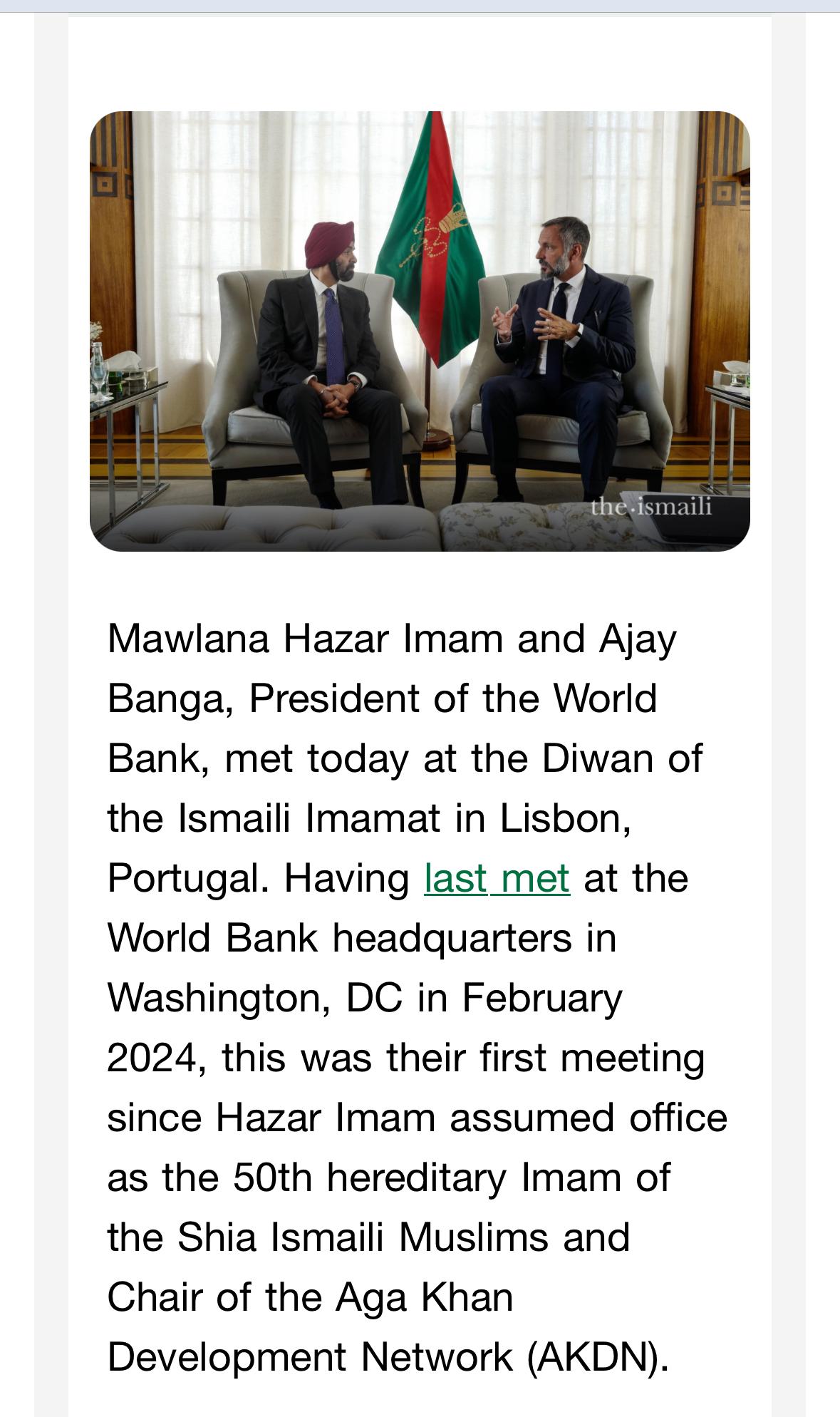

Ajay Banga, President of the World Bank, and Mawlana Hazar Imam at the Diwan of the Ismaili Imamat in Lisbon, Portugal.Photo: AKDN

Mawlana Hazar Imam and Ajay Banga, President of the World Bank, met today at the Diwan of the Ismaili Imamat in Lisbon, Portugal. Having last met at the World Bank headquarters in Washington, DC in February 2024, this was their first meeting since Hazar Imam assumed office as the 50th hereditary Imam of the Shia Ismaili Muslims and Chair of the Aga Khan Development Network (AKDN).

They discussed matters of mutual interest, including development priorities in Afghanistan and the wider Central Asia region, Syria, addressing the climate crisis, expanding clean energy in Africa, and job creation.

The World Bank and AKDN have a long history of collaboration and partnership, spanning multiple countries and sectors, including energy, financial services and telecommunications, as well as agribusiness, community development, entrepreneurship, health, microfinance and tourism.

Heartening that Hazar Imam - His Highness the Aga Khan - met with Ajay Banga, President of the World Bank Group, at the Diwan of the Ismaili Imamat in Lisbon on 1 July 2025.

In light of that dialogue, it is appropriate to recall the comprehensive scope of collaboration to date—spanning loans, equity investments, exited partnerships, grants, and blended finance—between the World Bank Group (IBRD/IDA/IFC/ARTF) and the four for-profit constitutional institutions of AKDN/AKFED under the Ismaili Constitution.

These institutions are bound by His Highness’s Farmans for inclusive and sustainable community led development.

Yet, the community leaders have withheld also, the Ismaili Constitution, details of these partnerships, contrary to His Highness’s directives—thereby betraying the trust and respect they profess & have committed to

TheIsmaili - media - should also give more facts to the Jamat & public For example,

Below is a detailed summary of World Bank Group engagement with AKDN entities:

Active & Ongoing Projects

Tajikistan – Pamir Energy

• IFC equity (US $3.5 M) + AKFED equity (US $8.2 M) + IFC/IDA debt to rehabilitate hydro infrastructure in Gorno-Badakhshan (total cost ~US $26 M)

Afghanistan – EMERGe Program

• ARTF grant: US $16 M to AKF‑Afghanistan and ACGF, benefiting microfinance institutions (FMFB‑A), with a strong focus on financial inclusion for women-owned businesses

FMFB‑Afghanistan (IFC & KfW)

• IFC remains a shareholder alongside AKF–USA and KfW, reinforcing SME and housing microfinance growth

Pakistan – First MicroFinance Bank Ltd.

• IFC equity and debt support for FMFB–Pakistan under AKAM umbrella, focused on rural financial inclusion

Tanzania – Diamond Trust Bank (DTB)

• IFC long-term financing and equity investment in DTB, where AKFED is a major shareholder

Mozambique – Moztex (Textile Manufacturing)

• IFC loan and advisory support to AKFED-backed Moztex, promoting industrial employment and exports

Kenya – Frigoken Ltd.

• IFC advisory and financing support for AKFED’s agribusiness subsidiary, working with 50,000+ smallholder farmers

Uganda – Nyagak I Hydro (IPS)

• Majority-owned by AKFED via IPS; banking partners include DEG and IFC (expected co-financing)

Kenya – Kipevu II Power Plant (IPS)

• IPS investment in thermal power generation; IFC and DEG involved in financing structure

Tanzania/Zanzibar – Aga Khan University & Heritage Sites

• Joint initiative supporting AKU: IDA loans (~US $30 M) + IFC equity (~US $10 M) alongside US $90 M AKDN investment

• Heritage restoration in Zanzibar seafront funded by US $2.4 M World Bank investment

Serena Hotels (Africa & Asia)

• Built with IFC support as part of the long-term partnership dating back over 30 years

Exited & Completed Investments

FMFB‑Tajikistan (2005–2015)

• IFC provided equity and debt over a decade, exiting fully in 2015 by selling its stake to AKFED

Tourism Promotion Services – Pakistan

• IFC exited equity investment in Serena Hotels Pakistan after supporting expansion and modernization

Estimated Financial Scope

Based on publicly available data and conservative estimates:

• Total active and historical loans, grants, and equity investments involving AKDN and the World Bank Group exceed US $200–250 million

• Equity investments by IFC in AKDN entities are estimated at US $30–40 million

• Grants and concessional finance (e.g., ARTF, IDA) exceed US $60 million, particularly in fragile contexts like Afghanistan and Tajikistan

These figures are indicative, not exhaustive—yet they underscore the substantial scale of engagement.

Summary - chart

https://x.com/chaturmahebub/status/1940 ... hqfO552USg

Governance & Disclosure

Despite the constitutional mandate for accountability, the following remain undisclosed:

• The Board of Directors of the Ismaili Imamat and its constitutional entities

• The executive leadership of AKFED, IPS, AKAM, and AKES

• The terms and conditions of World Bank–AKDN financial instruments - Loans

How many leaders & who - have an interest or a conflict in their business interests with those of the communities entities - directly & indirectly

This opacity is not only inconsistent with global best practices—it is inconsistent with the ethical standards His Highness has long championed.

A Call to Integrity

This renewed engagement at the highest levels reminds us that transparency and alignment with His Highness’s vision are essential—not optional.

I therefore urge all leaders and institutional stakeholders to:

• Disclose the full scope of World Bank–AKDN partnerships

• Publish the names and roles of directors and executive Boards of all our constitutional entities

• Engage the Jamat in understanding the scale, risks, and benefits of all programs and initiatives and include and enable the Jamat’s as Hazar Imam has directed

We are all called upon to be worthy of the trust placed in us by Hazar Imam and our faith and Trust to receive Farmans blessings and Mercy for Noor e Imam e Zaman

With best regards and in service,

M Chatur